When situated within the cyber marketplace, you are ultimately subjected to the hustle and bustle of securing a trading account so as to commence trading crypto coins. This entails the signing up for an account, submitting passcodes, and verification of the account. And these, mind you, may appear easy, with only the crypto investor needing a computer unit and a stable internet connection to get started. Erudite knowledge and the needed technical know-how to make use of platforms and exchanges can be learned within the trading endeavour.

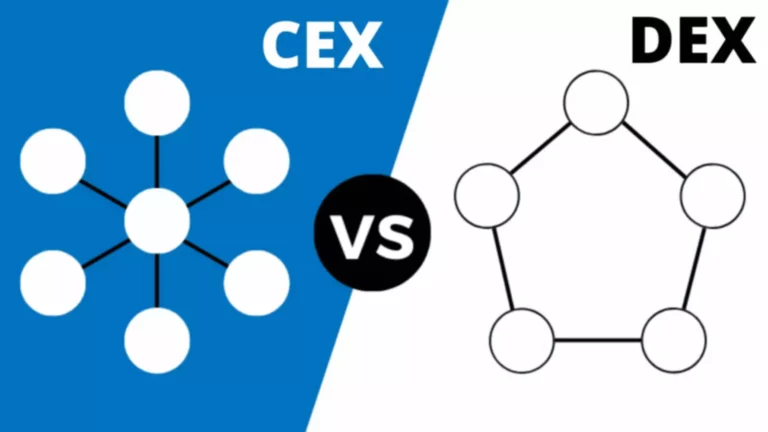

Looking into the types of cryptocurrency exchanges available to the crypto investor serves the cause well. To date, technology has provided the trading community two (2) kinds of exchanges, these are the Centralized Exchange and the Decentralized Exchange. The former had already been discussed in an earlier feature. Now we focus on the latter.

A Decentralized Exchange bears almost basically the same process with a centralized one; just subtract the signing up part and the verification. While it is a fact that Decentralized exchanges may prove more difficult to navigate, though, and that it may not always offer the crypto you’re looking for, using such opens traders to an innovation in exchange systems. And as crypto technology evolves, it is highly likely that these would be transformed into essential parts of the crypto realm.

Bitcoin’s ascendancy has spawned thousands of online crypto exchanges, which was crucial to creating equilibrium in the digital asset markets. This had been done through the matching of crypto buyer with the crypto seller. Not having these exchanges would have resulted in a chaotic, inefficient online trading marketplace where assets would have either been overpriced or underpriced.

Centralized exchanges made systemic online crypto trading possible. But as technology continues to churn out more innovative solutions, decentralized trades took root.

What DEx Exactly Is: How It Functions and the Theory Behind the Creation of Such

Decentralized Exchanges (DExs) allow those trading with cryptos to function bereft of an actual custodian. These exchange classifications run on a platform that imitates the inner workings of its centralized counterpart. The only thing that separates Decentralized Exchanges from Centralized ones, except for the custody of client funds.

In this short feature however, we will put emphasis on DExs.

Turnkey Brokerage Solution For Your Business

Get the most profitable fully licensed fx/crypto brokerage software or ready-to-operate business in 48 hours. Best-in-class web & mobile trading platforms, sales-driven CRM, full integration with MT4/5, and 150+ payment providers.

Centralized Exchanges vs. Decentralized Exchanges: The Difference Between the Two Platforms

In a Centralized Exchange, it is pertinent that a trader deposits funds to commence trading. This is done via the exchange employing the funding method, which is usually via bank/card transfer of fiat currency or depositing cryptocurrency.

The act of depositing your trading funds is basically giving up your control over it and allowing the exchange to assume custody. Note that this does not, in any way, mean you cannot use your funds how you see fit. You just cannot spend through the blockchain.

This submission of custody means not having your private keys to your fund storage. In essence, you will have the custodian to transact for you. In effect, your transactions will not be found on the blockchain but are placed on record within the database of your exchange.

Decentralized Exchanges allow users, to still hold the reins on their account through cryptocurrency technology for safer and more transparent trading transactions.

The Three (3) Different Types of DExs

- The Automated Market Makers (AMM)

Significantly different from the first two types, AMMS do not operate through the use of order books. Instead, these make utility of smart contracts to create liquidity pools capable of executing transactions on preset parameters.

However, as with other DEXs, an on-chain transaction is required so that trading transactions would be conveniently settled.

- The On-chain Order Books

DEXs classified under this operate all the transactions within the blockchain. This is known to be the most transparent among the other systems with the absence of third parties when the orders are processed. This makes client funds safe.

However, among the other types, on-chain order books is seen as the most inexpedient due to its fee infrastructure as the user asks the node to permanently store the records. However, this entails the waiting of the user for a miner so that the message could be added, making it a laborious situation.

- The Off-chain Order Books

These operate a centralized entity that takes full charge of the order book.

In contrast to on-chain order books, transaction records are recorded in off-chain books through a centralized entity. These command books are managed by what are called “relayers.” Off-chain DEXs, as opposed to the other two DEx classes with consideration to this, are only virtually decentralized.

Now that we have laid down existing types of Decentralized Exchanges, let us weigh DEx usage by gleaning through its offered advantages and unshakeable setbacks.

Weighing In: Three Advantages and Three Setbacks of Decentralized Exchanges

Here are some of the advantages of trading with Decentralized Exchanges:

Skipping the tedious verification process – with DEXs, the verification process is done away with to prove their identity. For some, they find sending personal documents such as IDs, as a concern for privacy. Information leak is possible as they give out their personal information. In DEXs, some policies like the KYC and Anti-Money Laundering are no longer put in place.

No third party risk – DEXs’ primary solution is the elimination of client fund custody. This avoids other potential threats such as cryptojacking and hacking, among others. Also, traders are in full control, giving them the liberty of using their own assets when they deem fit.

A wider selection of cryptocurrencies – tokens that are not available with several exchanges can be traded in DEXs as long as there is supply and demand for such cryptocurrencies.

While a lot of benefits are evidently possible with using a Decentralized Exchange, fact of the matter is, there are still setbacks of using the platform. here are three of these:

Inconvenient – There are some inconveniences to traders who are used to Centralized Exchanges. For instance, traders who forget their private keys that they have authored for their coin storage can easily reset their passcodes given that the system serves as their custodian. In DEXs, however, traders who forgot what their private keys are will have to let go of their stored crypto tokens altogether as there is simply no recovery function that would safeguard users from this normal occurrence.

Market Liquidity – Liquidity is a marker for those looking into easily buying and selling their assets at an affordable price. DEXs have low liquidity since most traders trade through CEXs. DEXs traders will encounter more difficulty in looking for buyers or sellers wanting to trade crypto coins for prices both the common and advanced investors would want to buy.

Slow transaction time – Since trading calls are necessary that it be made known to the entire network and duly recognized by miners prior to such being processed, allotted time in processing bear the inclination of taking longer within the context of Decentralized Exchanges. With this instance, chances are, traders are privy to what is called, “price slippage,” or transaction failure caused by value changes in the cryptocurrencies traded.

Conclusion

The emergence of Decentralized Exchanges appears aligned with blockchain’s core solution: decentralization. Cryptocurrency technology has apparently elevated to a whole new level as DEXs brought significant modifications in an already functioning system. Mainly, DEXs underscore the eradication of the need for the custody of funds, which gives traders sovereignty. And this sovereignty allows for more efficient and safer trades, thus attracting more novice and even seasoned traders.

The continuous development and the evident innovations that the Decentralized Exchange technology offers will not only get the favor of more traders, but in turn will serve to improve liquidity. This will definitely leave Centralized Exchanges greater motivation to improve on what they have existing in their system so as not to lose their own patrons.